BBC Easy is an automated borrowing base management system for financial institutions and businesses. Managing Borrowing Base Certificates today is cumbersome and often leads to errors. BBC Easy automates the borrowing process from beginning to end. BBC Easy's features allow you spend less time worrying and more time focusing on growing your business.

|

|

NEW BORROWING BASE |

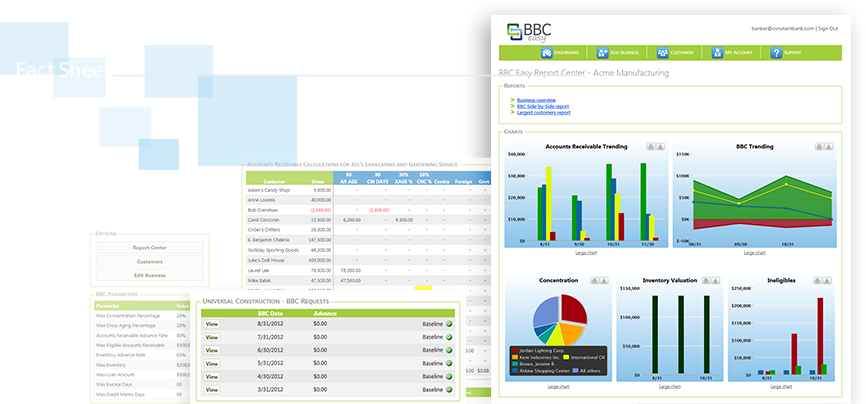

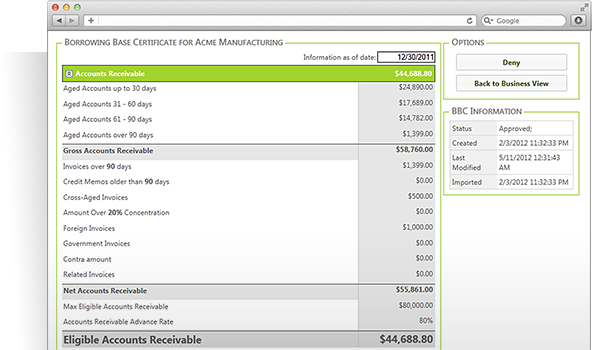

Now Create your BBCs with the Click of a Button It's time to love BBCs. No more 10-key; no printing; no scanning; no faxing. We link directly with the accounting software to read the required information. The lender sets the BBC Parameters and BBC Easy reads the specific data when the borrower submits their BBC. We currently integrate with several industry leading accounting systems and are continuously working to add new support. |

|

The 30-second BBC Patent pending technology reads lender specified data straight from the accounting system. Calculations that used to take hours now take less than a minute. |

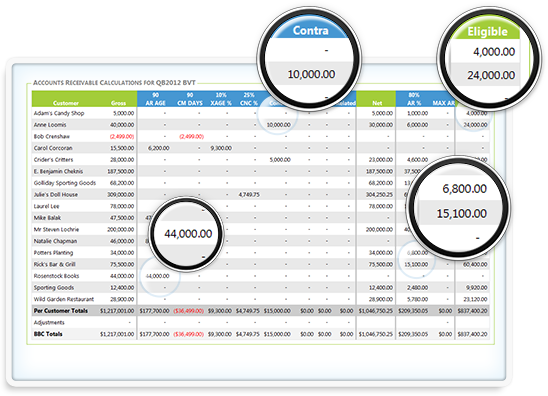

Real-time Information Instantaneous reports and charts are calculated for every individual customer. Discover trends faster and reduce risk. |

||

|

|

||

|

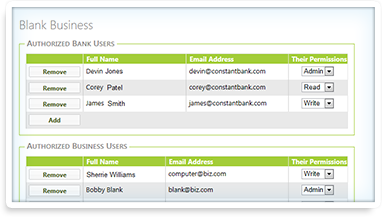

Control access with advanced user-management Various levels of access can be configured based upon roles and responsibilities befitting their role. This flexibility allows lenders to provide access to analysts or partners to review previously private portfolios. Likewise, businesses can enable third-party access rights for outsourced accountants or CFOs. Access can be granted in read, write, or admin levels depending upon the needs of the users. |

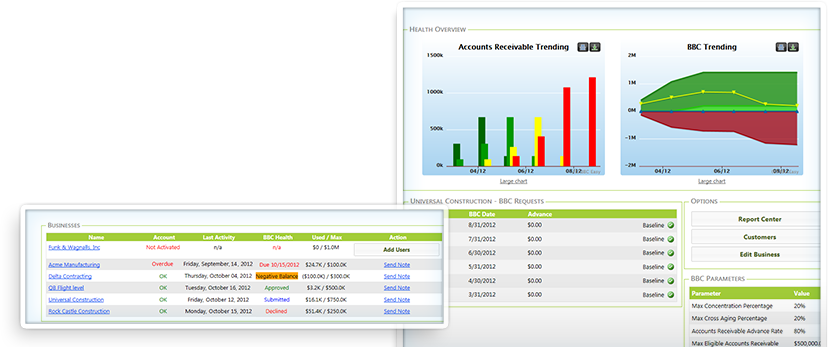

Dynamic Dashboards for Lenders and BorrowersBusiness Health Overview pages provides a summary of the recent BBCs along with trending charts for Accounts Receivable and BBC health. Lenders use their dashboard to prioritize their daily work activities: items that need to be addressed float to the top such as overdue BBCs and borrowers who have not yet activated their account. Enjoy more information at your fingertips with an at-a-glance summary of each borrower's line penetration and BBC status. Lenders can even maintain relationships by sending messages to borrowers right from your dashboard. |

Supporting a full set of BBC ParametersWhen lenders create a new business in their dashboard, they are able to request BBC calculations for all of the standard requirements: A/R Advance Rate & Maximum A/R, Invoice aging, Credit Memo aging, Concentration, Cross-aging, and Sales & Collections. Additional exclusions can be calculated based on account types such as Government, Foreign, Related, and Contra. BBC Easy also helps you track inventory valuation and advance rates either as a whole or separately for WIP, RAW, and Finished Goods. Remember, all of these calculations are ready for you in 30-seconds! |

|

|

|